Maintaining effective control over your debts, and paying them off as soon as possible, is a vital part in achieving financial freedom. One of the key elements of any wealth creation plan is the reduction of private debt (bad debt) as quickly as possible. The key difference between good debt and bad debt is that good debt can be used to purchase assets that produce passive income, whilst bad debt does not.

Bad debt works against achieving your financial success, rather than for it, and is generally non tax-deductible. An example of bad debt is a home loan for your place of residence and a good debt is a home loan for your investment property.

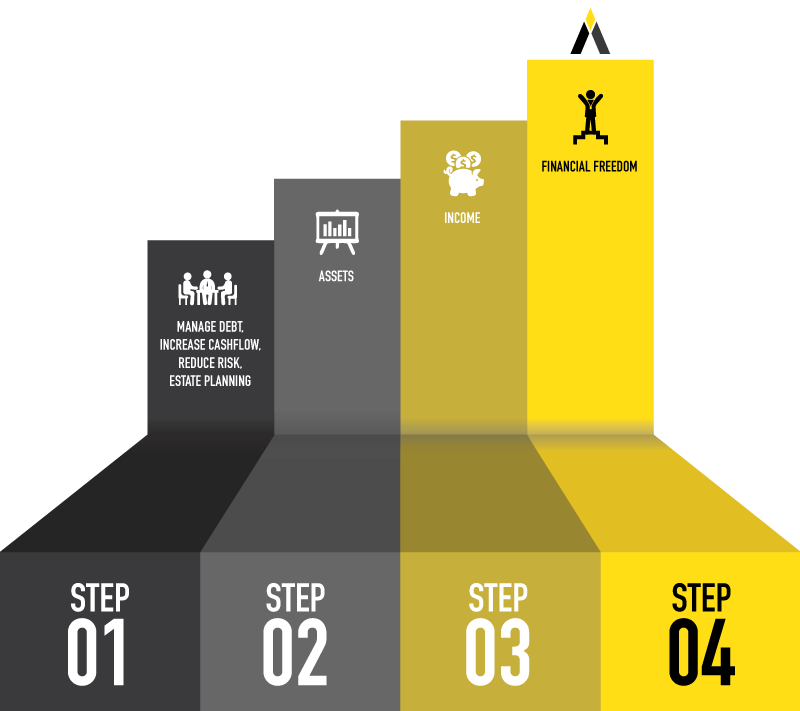

01. Create

Build your finances so they are working harder to help you achieve your goals.

02. Protect

Minimise risk by ensuring both you and your wealth are protected.

03. Enjoy

Gain the power to live the life you want and enjoy the fruits of your plan.