Estate Planning is an essential component of any financial plan. However when it comes to establishing a financial plan, Estate Planning is often overlooked or given very little consideration.

Most financial plans focus on creating, protecting and preserving your wealth only, but it is crucial that Estate Planning also plays a vital part in your overall financial plan.

Estate Planning aims to make sure that if you were to lose capacity or pass away then you and your loved ones will be ensured to legally reduce tax on your estate and that your assets are passed onto your loves ones according to your exact wishes. Also, what most people are not aware of is that a sound Estate Plan can also protect the assets that you pass onto your loves ones well after your death, in case your loved ones; suffer bankruptcy, get sued or go through a divorce, therefore keeping your assets in the blood-line for your family’s future generations.

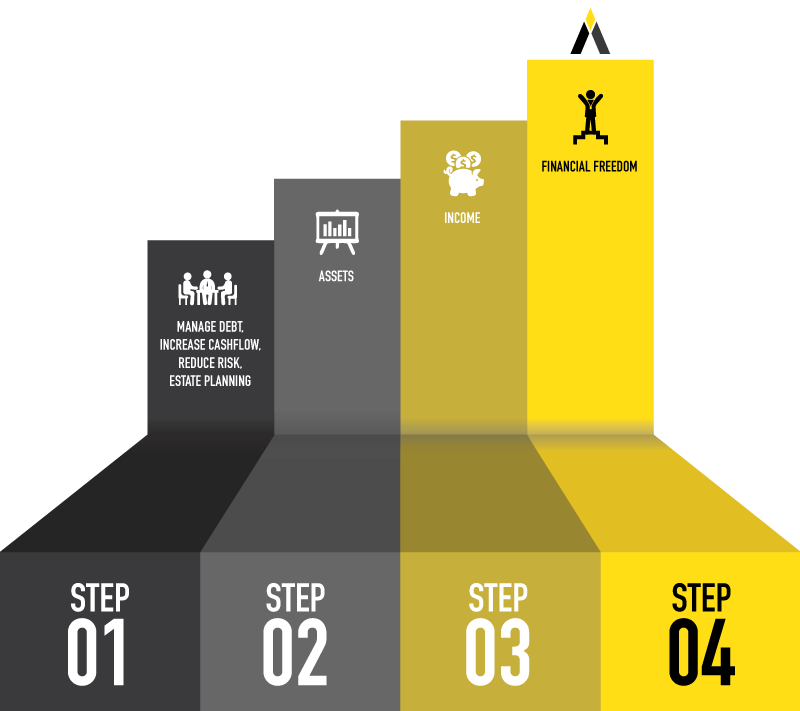

01. Create

Build your finances so they are working harder to help you achieve your goals.

02. Protect

Minimise risk by ensuring both you and your wealth are protected.

03. Enjoy

Gain the power to live the life you want and enjoy the fruits of your plan.